bring the Dutch housing market back into balance

This article also appeared in a short version in Dutch on Joop.nl

It will be clear to everyone that something is wrong in the housing market, but finding the key and then using it turns out to be difficult. Over the years, this market has been government-regulated on the part of buyers and social tenants, but deregulated on the side of investors and free market tenants. It is precisely this that ensures that more and more homes come into the hands of those investors and that more and more wish buyers are spending more money on their rent than a mortgage would have cost them.

The average starters are in fact unable to obtain a loan of € 350,000, which they could repay in full in the month over 30 years if they had received it for an amount of € 1,244 (interest rate 1.71% 20 fixed year, repayment 100% annuity 30 years, no transfer tax). But those same starters can rent a house from investors for the same amount or more, without building up a penny of capital. And this is not so much the fault of that investor, but of the system that the government has created, this system we call the housing market. The government wants to protect buyers against an irresponsibly high mortgage, but not against an irresponsibly high rent. This gives investors the opportunity to bid higher, because they can easily make a higher offer without having comparable restrictions on obtaining a mortgage. This with more than the variable costs such as rent, plus the proceeds of the increased house prices in prospect.

That inequality is caused by the lack of taxes and regulations that we impose on investors, so let’s zoom in on that. For example, investors buy the above home for € 350,000, by bidding € 400,000 for it. The bank gives a mortgage if they put enough equity in it to remove the risk. So a loan for about 75% of the value because the property decreases in value with tenants in it. The investors therefore put in € 100,000 and take out a mortgage of € 300,000. Those investors have to deal with 8% transfer tax and notary fees and therefore have to invest an additional € 35,500. The interest is higher for investors than for starters, but at 3.55% this is still only € 887 per month (10 years fixed rate, 75% market value, no repayment). Tenants are prepared to pay at least € 1,244 for this, because otherwise they would have had to pay that in mortgage payments and they still have to live. An increase of € 100 per month to cover maintenance costs is also appropriate.

In this example, the structure of the housing market has therefore ensured that the available € 745 in repayment of the first-time buyers is used for extra interest income for the bank, extra return for investors and extra transfer tax. The tenants concerned see nothing of it. As starters, the same tenants are not allowed to make an extreme offer of € 450,000 on the same house, because then we have to protect them against themselves. Despite the fact that this had only cost € 642,- interest per month and therefore € 602,- had gone to the own repayment. This would allow them to repay the entire loan in 40 years on an annuity basis under the same conditions. This is an extra mortgage for 10 years with the advantage of a repaid house after 40 years. Tenants with the same costs have nothing after 40 years.

On the contrary, tenants are confronted with rising house prices and rents, which potentially increases their problem of buying or renting a house. All in all, a protection that turns out badly for those who don’t know how to own a house. Borrowing more is not the solution, because that only drives up the price. That is only to the advantage of current home owners. As a result, new buyers only have to pay extra interest and repayment for the same house that they can now get even worse because of the increased prices. The buyers who sell a house now have even more equity to offer.

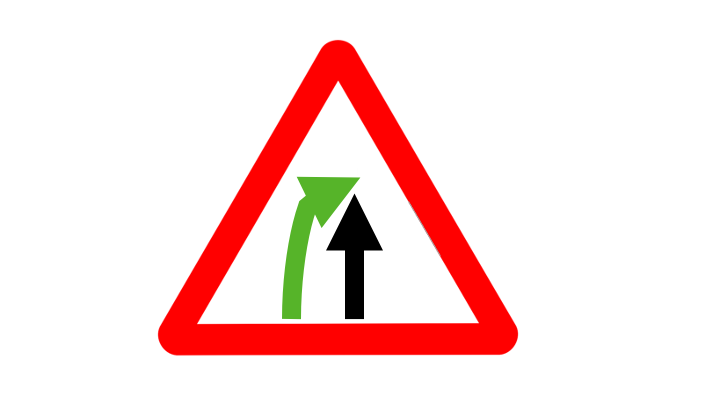

To solve the problem, the focus is now on building additional buildings and a self-occupancy obligation. In itself mainly progress, so do, but the underlying inequality is not tackled with it. More supply creates more demand and that basically goes to the people who can afford the most, that is the investors. They then buy up the houses that are not subject to the obligation to occupy themselves, so that there are more first-time buyers for the other houses.

Current taxes

In this example, the tax authorities see assets in box 3 of €400,000 with a debt of €300,000. The debt may be deducted from the assets, so this is seen as a taxable asset of € 100,000. This while the entire capital of € 400,000 is invested and money is therefore earned. The tax authorities assume a levy on this capital of € 100,000 of at least 4.501% and a maximum of 5.69%, depending on the amount of the total capital. 31% tax is levied on this, so a maximum of €1,763 per year is levied by the tax authorities, regardless of the actual return. The actual return in this example without maintenance is € 4,284 per year, so 4.284% of the € 100,000. In this example, € 2,521, net per year, remains for the investors. Everything they know to add gross to this through higher rent or more favorable interest is immediately more net profit. A higher percentage of borrowed money will reduce the tax even further in favor of being able to get more properties and therefore a much higher return on the invested capital.

Later on, no tax has to be paid on the sales profit, because of this only the capital grows. Everything that covers the later sale more than the € 35,500 in transaction costs and maintenance costs is therefore tax-free profit. With an increase in house prices of 4.3% per year (CBS 1996-2013), the house can be sold for € 930,205 in 20 years if the tenants move out at that time. At 1% maintenance costs, there are therefore € 4,000 annual costs, that is, with the same price adjustment to the value increase of € 123,017 in 20 years. So a € 930,205 sales proceeds minus € 35,500 purchase costs minus € 123,017 maintenance costs, plus € 28,583 maintenance coverage and minus the € 400,000 in purchase is € 440,271 tax-free profit over 20 years. Adjusted for an inflation of 1.8% (CBS CPI 1996-2020), this is a return of € 14,008 per year. So € 14,008 per year extra that is adjusted for inflation every year if the sales return is included. Then those investors suddenly have a gross return of € 18,291 per year, which equates to a net return of € 16,529. That is an average net return of 13.6% on the invested capital of € 135,500 and an actual tax rate on the entire return of 6.5%. The actual tax rate may deviate positively or negatively, as the tax is not based on the actual return, but on the notional return of 5.69% on capital minus debt. An interest rate rise after 10 years can still have a negative effect on costs and therefore the return. But every euro of extra sales value and every euro of lower maintenance costs is a euro more direct net return.

Taxing the actual return

Taxing landlords’ actual returns would already make the system fairer, dampening investor benefits. The actual return means a tax on the rental income and the sales proceeds less the related costs. If the above house is then sold by investors after 20 years, they will have had € 930,205.49 in sales proceeds, plus a total of € 355,574.80 in rental income. The costs were € 103,500 in purchase costs and € 212,880 in interest costs and € 123,017 in maintenance costs, plus € 300,000 in mortgage to be repaid and € 28,583 in maintenance coverage. That is a total profit of € 542,966. Paying 31% tax on this would amount to €168,319 tax in total instead of €35,872 capital yield tax now. Such a big difference between tax on income and tax on invested capital is inexplicable and ensures that people with wealth invest massively in the housing market instead of working more.

This, too, will not completely reduce investors, because even after taxes, it will remain a net income of € 12,401 per year in 20 years, which will keep pace with inflation. That is an average net return of 10.3% on the invested capital of € 135,500, compared to an average net return of 13.6% on an invested capital of € 135,500 now. It remains difficult to keep investors from the housing market with the above measures, because ultimately the money is mainly made from the rise in house prices. The rental income is only used to keep the cash position stable and ultimately to be able to cash out tax-free upon sale.

Maximizing mortgages for investors

The inequality is caused by the lack of rules that we impose on investors. Normal buyers only receive a mortgage if it is in a certain proportion to their income, whereby they are obliged to repay. Investors receive a mortgage if it can be paid from the income from the rental of the property and do not have to make repayments. There is only a maximum of 75 to 80%. So if investors can demonstrate that they can find tenants, they will be borrowed 75% of the value without having to have any real income. They just have to be able to cough up the other 25% and the transaction costs. Here, the buyers are thus protected from themselves and the investors are given free rein. Who is or is not allowed to get a mortgage according to the rules is therefore heavily in favor of investors.

Setting rules for investors to obtain a maximum loan for the purchase of a rental home reduces this difference. By allowing rental income to count for a maximum of 50% for investors income and a maximise a mortgage to 50%, these investors suddenly have to take with them twice as much for the purchase. So they can effectively only buy half the number of homes. The average net return then falls back to 8.2%.

No longer deduct debt from assets

In addition, not being allowed to deduct the debt from the assets ensures a better representation of the actual taxed return. After all, investors have the entire risk and return on the entire € 400,000, but choose to take on a debt in order to be able to get the same risk and return a few more times. There are costs associated with this in the form of interest, but the interest is never as high as the income. After all, the bank does not share in the increased house prices, it gets the original amount back plus the interest. It is better to earn 6% on € 100,000 and then 3.5% on € 300,000, then 6% return on € 400,000. The first is in fact 16.5% on € 100,000 and you can also execute 4x if you have the entire € 400,000. Simply ignoring the debt is a better starting point for taxes. Then you make 6% return with your own money and 4.1% on € 400,000, which has been borrowed for 75%. Not allowing debt to be deducted from capital in itself ensures an actual average net return of 9.8%, on the invested capital of € 135,500. Combined with a maximum of 50% mortgage, this is an average net return of 6.9%.

Increase transfer tax for investors

By also increasing the transfer tax for investors to 15%, this can be further reduced to an average net return of 5.4%. All this to discourage investment by investors in favor of home buyers who want to live in it themselves. Of course, these rules must also apply to investing via a BV and NV. Anyone who wants to continue investing for retirement or does so to house the company or a family member is still making a return with rising house prices. Only if house prices remain the same maybe not all maintenance costs be covered. But you also do not hear the buyers whine about the maintenance costs that they have to incur on top of the mortgage. So it’s only fair that the chance of return also comes with a risk of loss.

Give current tenants a right to purchase

These measures will bring the regulation of the housing market into balance. Not only are buyers limited in what they can borrow to purchase their own home, but so are investors. After all, both can drive up prices if they are allowed to borrow indefinitely. Limiting one of the two ensures that the other can only drive up the price and thus effectively buy everything. The investors are in themselves already the stronger party because they can base their income on income generated by their tenants and therefore not generated by themselves. It is therefore only logical to limit the investors more than the starters.

All this only regulates the players who enter the market or want to purchase additional investment properties. It does not help the current tenants for whom no non-occupied home is currently available. A simple solution could be added to help them. Give (existing) tenants the right to buy their rented house for the market value, provided they can get a mortgage for this. This is of no use to someone in social housing, because in principle they should not be able to pay the mortgage. But someone who is forced to rent is actually already paying the cost of the mortgage, but as rent. Or in many cases where they could not otherwise, even rent for more more than the actual mortgage costs. If these have the right to buy their rented house from the investors, they have suddenly become starters too, because they can afford the mortgage.

The only real disadvantage that investors then have is that they have a bag of money and have to look for an investment again. If this purchase does not provide sufficient cover to recoup the transfer tax, the state would have to refund it. For the state, this means that a purchase is retroactively made by starters instead of investors. Investors must then be able to get rid of their mortgage without penalty interest. This shouldn’t be a problem for the banks, as the mortgage interest rate for an investor is substantially higher than that for a private individual, so apparently such risk has already been discounted. And on average, there is simply another higher mortgage with a bank.

So, in order of most effect:

- Maximise to 50% mortgage for an investment property to limit investor advantage over regulated buyers;

- Give a right of purchase to all (existing) tenants at the free market value, whereby investors can get rid of their mortgage without penalty, in order to rectify the current imbalance.

- Pay tax on the actual return on renting and selling (old) rental properties, in order to prevent infinite reinvestment and to distribute taxes more fairly;

- 15% transfer tax for investors to limit investor advantage over regulated buyers;

- No longer deduct the (mortgage) debt of an investment from the taxable capital, because deductions negate the leverage effect on the profit;

Current investment profit

If you have the idea that investors are being treated too seriously with these measures, here is a calculation example if you have € 135,500. I have just given you an ideal plan to make this more and more. But beware, this is not investment advice! Legislation may change if others are also aware of this benefit. It is assumed that the purchase of a house of € 400,000 is for rent, with a 75% mortgage, without repayment, with a fixed-interest period of 10 years. With the € 14,928 in rental income per year, which is increased every year with the inflation of 1.8% (CBS CPI 1996-2020) and on which you have paid € 10,644 in interest and € 1,763.90 in tax every year you received a jar of € 43,327 after 11 years. If you then bring your old mortgage to 75% of the current home value of € 636,275.78 (an increase in house prices of 4.3% per year in accordance with CBS 1996-2013), you will have a total of € 226,290.93 to cover the 25% investment contribution and to pay the 8% transfer tax and other closing costs. So you can already buy the next property. In the meantime, all you have to do is cover the maintenance costs elsewhere (€ 4,000 per year, which increase with house prices).

You now own 2 properties of € 636,275.78 each with a 75% mortgage, for which you pay 2x € 1,412 per month interest (10 years fixed rate, 75% market value, no repayment). You will receive 2x € 1,513.72 rental income per month and now pay a total of € 5,611.00 per year on capital gains tax. After 6 years, you can afford an additional property in the same way for the then current value of € 819,598.33. Okay, the € 12,725.52 per year in maintenance costs may now be a bit much to bear yourself. If you pay the maintenance costs for the two buildings together entirely from your pot, you have considerable negative income. However, you still have a positive return due to the appreciation in value, so this is more of a cash flow problem.

If you do not have the cash flow to permanently finance the maintenance costs, you will still have to charge a slightly higher rent. If you start at the very beginning with € 100 more rent per month, you are already there. You can then always cover the maintenance costs from the income. So you only need to start with a rent of € 1,344 instead of € 1,244 per month. It now takes 2 years more before you can finance the next property. At that time you will have to look for 2 new tenants who can each pay € 625 per month more than the inflation-increased rent of € 1,649. But that is still too much at € 2320 per month to do. Or you decide to carry out less maintenance for the time being, more landlords seem to do that.

All in all, you’re still a lot better off than your prospective tenants who could only get a mortgage through you and give you all the benefits. After 20 years you can sell the two properties, at the moment your tenants already leave, for € 930,205.49 each and you have a net proceeds of € 722,968.62 on an investment of € 135,500. And in all that time you only had to pay € 65,671.17 to the tax authorities as a capital gains tax and € 87,384.38 as transfer tax. This is recalculated to an average net return of 18.6% per year. Not bad earned as a responsible small investor!

1 reactie

[…] English version […]